What is Encompass Partner Connect?

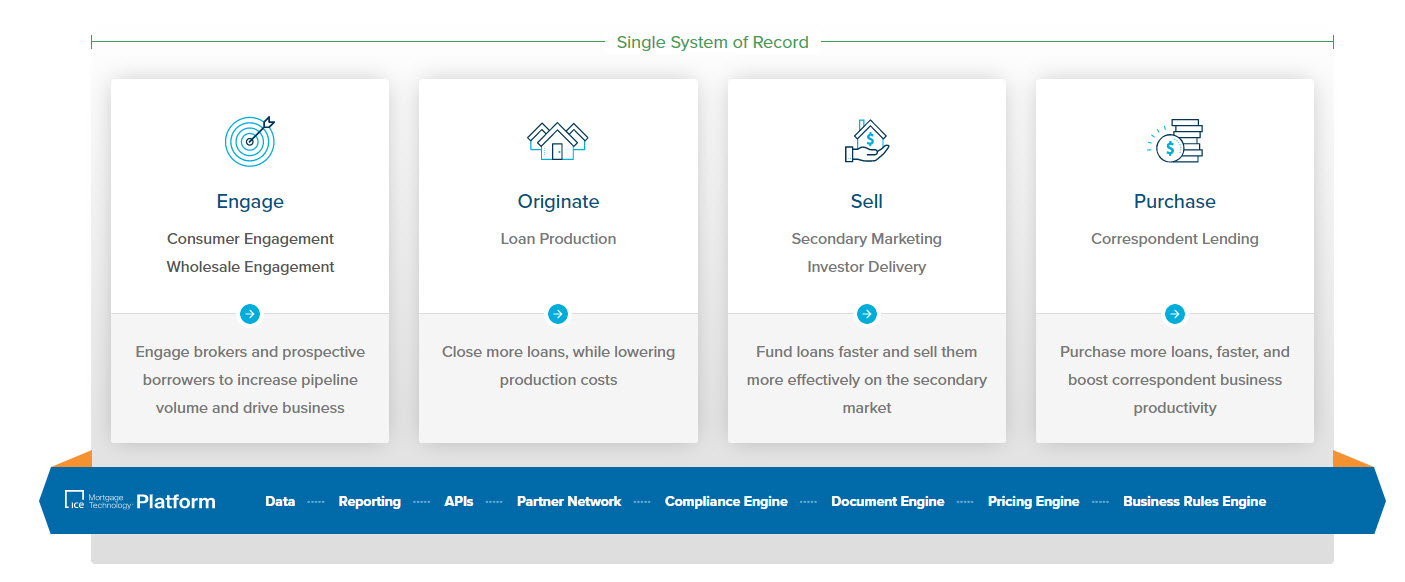

Encompass Partner Connect (EPC) is a cloud-native, 3rd-party-services integration platform that enables service providers to seamlessly offer their products and services to lenders on the ICE Mortgage Technology Digital Lending Platform.

EPC is the next-generation iteration of the ICE Mortgage Technology Partner Network integrations platform. Today, ICE Mortgage Technology (IMT) Lenders can take advantage of the various products that have been integrated with Encompass via Partner Network. These products include consumer credit reporting, property valuation, title and closing, loan program search and pricing, mortgage insurance, verification of assets/liabilities, income, tax returns, and many others.

In addition to providing parity with Partner Network, EPC offers exciting new capabilities and development paradigms to Partner integrators, some of which include:

Build Once, Use Everywhere 👨💻

Partners need to build and release an integrated product only once. Once a product is released, Lenders can use it in all of IMT's Lender-facing applications, including Encompass, Consumer Connect and TPO Connect

You Build it, You Own it 🚢

Partners are enabled to enhance and innovate their integrated products on their own timeline, and are not bound to IMT's release schedule or custom enhancement request pipeline.

Lender APIs out-of-the-box ⚙️

Once a product is released, it is instantly available through the Developer Connect Encompass API suite. Lenders can put orders through a products user-interface, or via a simple REST API. These APIs enable Lenders to innovate and build sophisticated ordering workflows.

Lender Automation out-of-the-box 💡

EPC supports 1-Click and automated ordering functionalities for Lenders. EPC products can be configured to automatically place orders when loans fulfill certain conditions.

Performant, Resilient, Scalable and Secure 💪

EPC is built with scale, resilience, security, and supportability being top-of-mind.

Updated almost 2 years ago