One-Click and Automated Service Ordering

Encompass (desktop and web editions) offers support for automatic service orders when a loan fulfills certain conditions. This is referred to as Automated Service Ordering, or ASO. Any EPC integration can be configured by a lender administrator to submit automated orders. This powerful feature is designed to function as a pillar of the automated workflows in Encompass Web and Mobile, and to reduce the manual workload for lenders' personnel. A lender administrator can configure all of the following with respect to automated service orders:

- Which services can be ordered automatically

- The provider to which a service order request is submitted

- Order "templates" to be submitted with each order. These are defined as “Automated Options” using a special administrator facing order template creation interface implemented by the partner.

- The loan conditions which, when met, will fire the automated order (automation conditions). These are defined using the standard business rules scripting language in Encompass, and are represented in the service setup screen as “Ordering Options."

- The level at which data will be assembled for the order (loan, borrower/co-borrower pair, or individual borrower)

Order Options:

Within each automated order option, the lender admin can define multiple “Automated Options.” These are pre-configured options that are set up in advance using a special administration HTML page that is defined, built, and owned by the Partner. Fields contained here will be “pre-filled” when an order is placed, and will represent order options that are required for the order but are not necessarily stored as part of the loan. An example of this might include:

- Credit Report type (PreQual or Full RMCR)

- Appraisal type (Drive By or Standard)

- Title Order Type (Title Only, Settlement Services Only, Title and Settlement)

- MI Product Type (Delegated, Non-Delegated or Contract Underwriting)

As owners of this pre-configured order options interface, Partners also can build in business logic to assist the lender admins in pre-configuring the options for Automated and 1-click Ordering. For example:

- Conflicting pre-config values could be disallowed (i.e. an MI Refund Type of "Not Refundable" may not be permitted if the MI Payment Plan is "Annual")

- Pre-configuration options could be presented differently, as determined by the lender's identity

While multiple of these “Automated Options” sets can be defined for a single “order option," only one can be designated as active at any given time. There is currently no functionality to attach any selection rules to an “automation option” within a given order option.

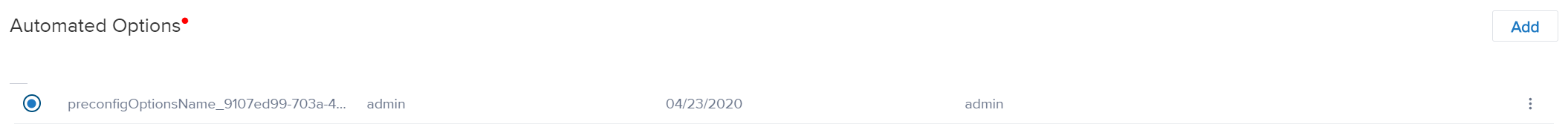

Automated Options

Ordering Options:

It is important to note that within any given service category, multiple “ordering options” can be configured, each with its own automation criteria. These options are then ranked with respect to one another. When the automation logic is evaluated, the first option that is evaluated as “true” is fired. For example, a lender may define automated ordering options with the following rules:

- Provider = “ABC Company” | Automated Readiness Condition: Loan Type = ‘Conventional’

- Provider = “LMNO Company” | Automated Readiness Condition: Loan Type = ‘FHA’

- Provider = “XYZ Company” | Automated Readiness Condition: Loan Type = ‘VA’

When these readiness conditions are evaluated, the first “hit” will stop the evaluation process and that order option will fire. In the example above, if the loan type was = ‘FHA’, the second automated order option would fire, and the order would be submitted to provider ‘LMNO Company’. There are no restrictions on the number of order options or the complexity of the readiness condition rules.

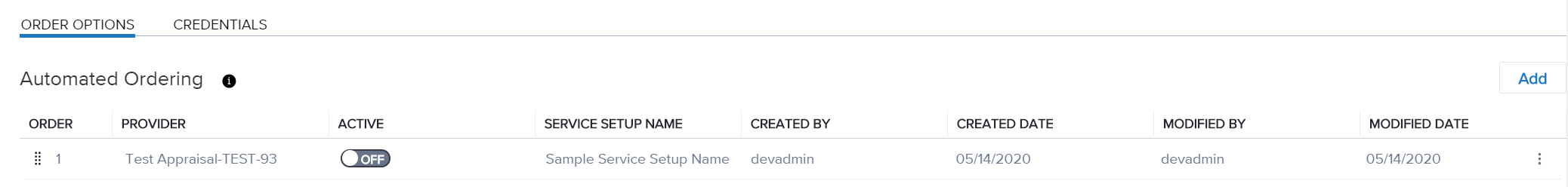

Ordering Options may be made active or inactive at any time by the lender admin.

Ordering Options UI

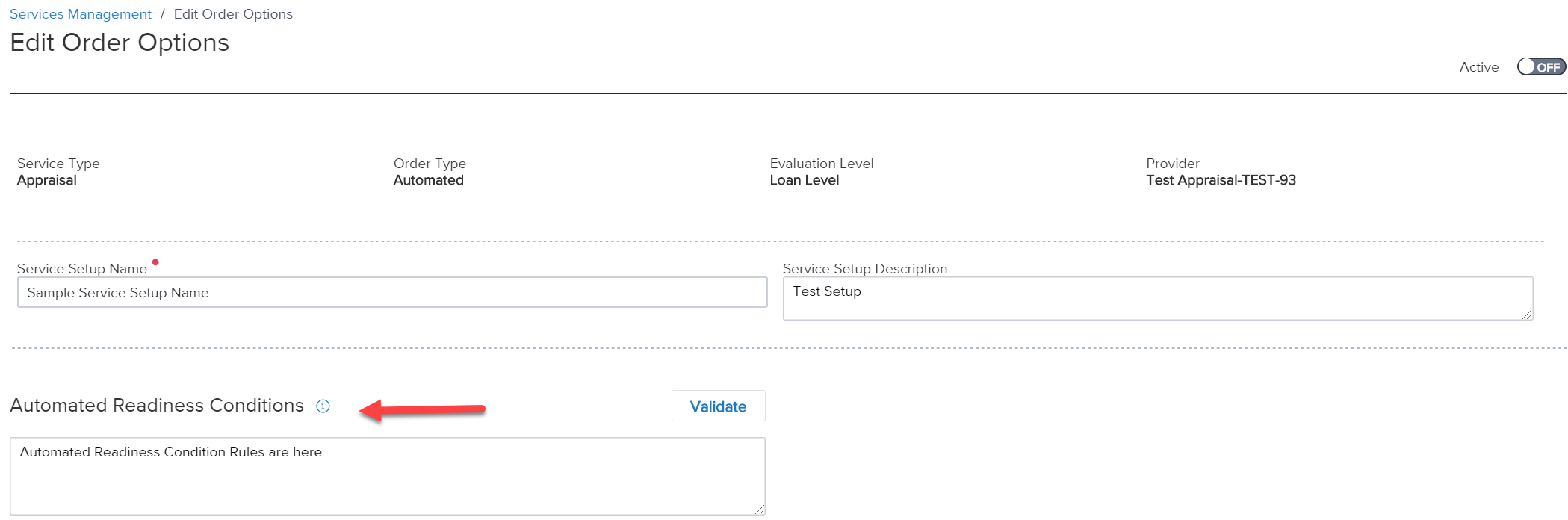

Ordering Option Detail: Automated Readiness Conditions

Automated Options and Ordering Options Together:

Ordering options and automated options can be used together. For example, if you wanted to ensure that all the FHA loans were automatically submitted to the provider “LMNO Company” with a pre-defined appraisal type of ‘FHA URAR’, you might set up ordering options and automated options like the following:

- Ordering Option #1: Provider = “ABC Company” | Automated Readiness Condition: Loan Type = ‘Conventional’

a. Automated Option #1: Appraisal Type data = ‘’1004 URAR” - Ordering Option #2: Provider = “LMNO Company” | Automated Readiness Condition: Loan Type = ‘FHA’

a. Automated Option #1: Appraisal Type data = ‘’FHA URAR” - Ordering Option #3: Provider = “XYZ Company” | Automated Readiness Condition: Loan Type = ‘VA’

a. Automated Option #1: Appraisal Type date = “VA Certificate of Reasonable Value”

When the automation process is triggered (on loan save), the ordering options above would be evaluated in order. For any FHA loan, the system would stop when it reached option #2 and the order would be triggered. When the request is sent to the Partner, an appraisal type of “FHA URAR” would be included, so long as automated option #1 was designated as “active." Keep in mind that while multiple automated options can be defined for any given ordering option, only one may be designated (by the admin user) as active.

There are no restrictions imposed on the number of ordering options that are defined, or the number automated options that may be assigned to an ordering option. This process is limited only by the designs of the lender admin, although care should be taken to avoid over-complicating the rules.

ASO Triggers:

The ASO process is triggered on any loan save, with a built in 15-minute delay to allow for users to periodically save work while processing a loan. After a 15-minute period of no activity following a loan save, any active “Ordering Options” are evaluated (in order) for the loan.

Updated about 2 years ago