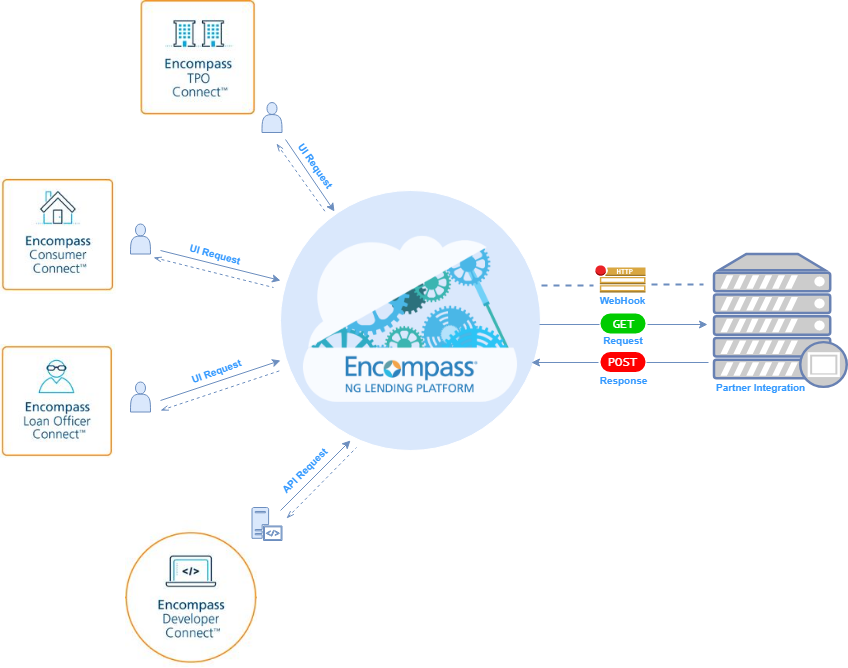

How does EPC work?

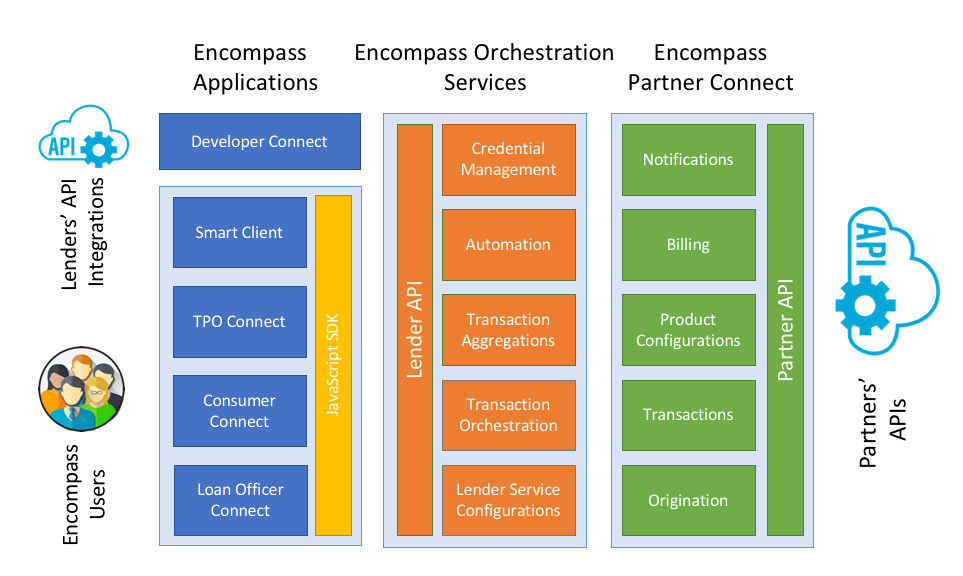

EPC provides a comprehensive Application Programming Interface (API) to Lender and Partner applications, which facilitates a governed exchange of data, documents, and transactional events - enabling simple and intuitive transactional workflows between Lenders and their Partner service providers.

At its core, EPC provides the following features to Partner integrators:

-

Product Configuration: EPC manages metadata and configuration settings for Partner-integrated products, which govern the products' access/listing, routing, entitlements, and more.

-

Transaction Origination: When a transaction is being originated on an integration's user-interface, EPC provides contextual information about the subject loan and originating user.

-

Transactional management: EPC facilitates service transactions on behalf of Lenders and enables Partners to fulfill transactions via its API.

-

Asynchronous Notifications: EPC notifies Partners of transactional events such as creation/updates, and exceptions in processing responses via Webhooks (HTTP callbacks), so that Partners can take appropriate actions when necessary.

-

Usage and Billing: EPC keeps track of transactions, accounting, and operational statistics for Lenders and Partners.

Under the Hood ⚙️

EPC is designed to be generic, and is purposefully loosely bound to the notion of a mortgage transaction. The benefit of this architectural approach is reusability. The same integration can be reused in many different applications. For example, a credit integration can retrieve a borrower's credit history where needed in a business process, be it an application for a residential mortgage or an auto loan.

Consequently, EPC must rely on an extended platform to read and affect mortgage applications: the Encompass Orchestration Services (EOS). EOS is comprised of a group of independent services that handle Encompass specific processes such as:

-

Updating the loan file with Partner transaction response data

-

Updating a loan's eFolder with documents attached to a Partner's transaction response

-

Managing Lender user accounts/credentials so that Lenders can place transaction requests without needing to enter their credentials every time

Multiple Channels of Origination...

Lenders are able to create new transactions with a Partner integration in multiple ways:

-

Interactive ordering via Encompass applications. An integration's user-interface is embedded within an IMT lender-facing application, such as Encompass (Web or Desktop edition). The lender interacts with this user-interface to manually initiate a new service request with, and receive updates from, the Partner integration.

-

Headless ordering via the Encompass Developer Connect (EDC) API. A user-interface is not involved. Lenders can invoke a service ordering API published on EDC, supplying the necessary data inputs for a Partner integration to contextualize and fulfill an order. Lenders use these APIs to build proprietary automated workflows in their loan processing ecosystem.

-

1-click/Automated Ordering via the Encompass workflow engine. An integration's administrator-facing user-interface allows Lender administrators to create transactional templates. Once saved, these order templates are associated with certain business conditions in a loan. When those conditions are met, a transaction begins via a single click by a user, or via an automation engine using the template created by the lender administrator.

...But a Generic Approach to Fulfillment

The EPC Partner API enables (and encourages) Partner integrations to be indifferent to a transaction's mode of origination. Notifications for all new transaction requests are received via the same mechanism (an HTTP callback), and can be similarly processed and fulfilled. This allows a single integration implementation to serve the breadth of interactive, 1-click, API based and automated ordering use-cases - enabling lenders to build powerful and intelligent service ordering workflows. The following developer guides will dig deeper into this important idea.

Updated about 2 years ago